Revocable Living Trust Form Ny

The type of assets you own and what must be done to get them funded into the trust should be carefully considered before you decide to use this estate planning tool.

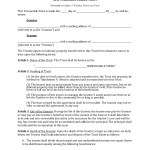

Revocable living trust form ny. The new york revocable living trust form is a legal document that is used to put a person s assets and property into a trust. This is the major drawback to using a revocable living trust for many people but it s not worth the time money and effort to create one if the trust isn t fully funded. Before you sign that revocable trust form read new york attorney jules haas s revocable trust faqs manhattan estate planning lawyer. It provides flexibility because you as grantor can impose conditions on the funds as to how when and for what purpose they are ddistributed.

This revocable living trust form can be employed to form a trust that is able to be terminated or repealed by the grantor at any moment. The person who forms the trust is called the grantor or the trustmaker and they also serve as the trustee of this type of trust in most cases controlling and managing the assets they ve placed there. The term revocable means that you may revoke or terminate the living trust at any time. A living trust in new york allows you to place your asset into a trust but still use them during your lifetime.

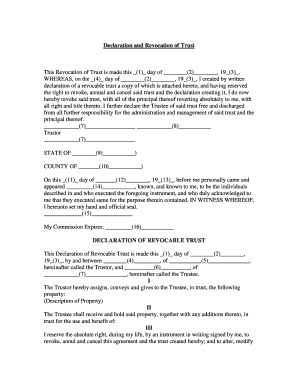

The new york living trust is an estate planning tool designed to avoid probate while providing long term property management. New york has a simplified probate process for small estates under 30 000. A revocable living trust sometimes simply called a living trust is a legal entity created to hold ownership of an individual s assets. Download this new york revocable living trust form which provides you with flexibility continuity and privacy as you think about providing for your loved ones upon your passing.

The grantor the creator of the trust will continue to benefit from their assets and income until such a time that they become incapacitated or die in which case it will be divided amongst the indicated beneficiaries. New york does not use the uniform probate code which simplifies the probate process so it may be a good idea for you to make a living trust to avoid new york s complex probate process. Your beneficiaries inherit them after your death. It is your liability to meticulously examine the legal document and ensure that the alaska revocable living.

Free consultation call 212 355 2575 jules haas is dedicated to serving our clients with a range of legal services including estate planning and wills trusts cases. The probate of an estate can be a long and costly process so it is worth investigating whether a living trust is a better option for ensuring that your estate is most effectively distributed. New york revocable living trust individual add to cart new york revocable living trust husband and wife add to cart new york living trust add to cart. The new york living trust is legal document whose primary purpose is to avoid the court appointed legal administration of a person s estate when they die or become incapacitated.

:max_bytes(150000):strip_icc()/GettyImages-522015476-3749ef1cf84449cd9988a0dcbebe17a2.jpg)